Using Candle Formage Fantom (FTM) Analyzing

Candlefish Diagrams are an effective tool for Technical Analysis, and in the case of analysis of cryptocurrencies Such as FTM (FTM), They can be particularly useful. In this article, we explore how candleboard diagrams can be used to analyze fantom cryptocurrency.

What is Fantom?

Fantom (FTM) is an open source, a decentralized and fully transparent blockchain platform that Enables fast, affordable and safe events. It was founded in 2017 by an Ethereum Community Developer Team, which aims to create a more scalable and effective alternative to bitcoin.

Understanding the Candlesticks

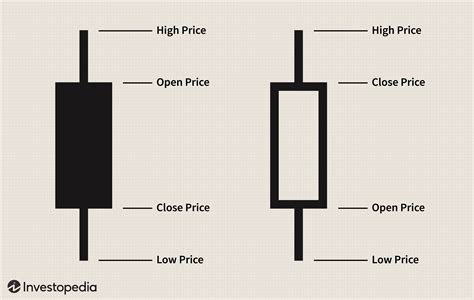

Candlefish Diagrams Are Graphic Shows About Prices About Time. Each Candle representents one trading day session with two main types of candles: upstands (green) and downhill (ed). The Color of the Candle Set Indicates The Direction of the Price Movement:

- Green = Upward Trend

- Red = downward trend

Use Candle Formatter to Analyze Fantom

Here are some key points that need to be tasks into account by use Candleboard Diagrams to Analyze the Fantom:

- Time Frame : Choose the appropriate Schedule for Analysis Needs, Such as 4 hours, One Day or 5 Day Candles.

- Candle Foot Pattert Recognition : Check out the general Candlestick Patterns of Fantom Blockchain, including:

* Hammer

* Shooting Star

* Rising

* A Declining Decline

- Fantom’s Relative Strength Index (RSI) : RSI is a pace indicator that Helps Measize the Strength of the Trend. Fant’s 14 -Day RSI HAS Recently Been Observed Slightly Overloaded, which refers to a Possible Turn.

- Support and Resistance : Identify Key Support Levels About $ 0.75 to $ 1.00 (Current Price Range) and Resistance Levels Approximately $ 2.50-00 (Historical Heights).

- Trade with Caution : Fantom’s Price Changes Can Be Quite Unstable, So It is Necessary to Be Careful in Trading. Consider the use of stop loss and profit on the use of your goals based on your analysis.

- Compare with Other Cryptocurrencies

: Analyzes the performance of Fantom in Relation to Other Market Cryptocurrencies, Such as Ethereum (ETH) or Litecoin (LTC).

Example of Use:

Suppose you are a merchant looking for opportunities to buy fantom $ 0.75-1.00 and sell it $ 2.50-00. Candlefoot charts Allow you to Identify the Following:

- A Rising Hammer Pattern With A High Share of Activity About $ 0.80 (Showing Strong Demand)

- A growing pattern with a small sales activity about $ 1.20 (Indicates Weak Seller Pressure)

- Support Levels: $ 0.75- $ 0.85 and resistance: $ 2.00- $ 12.10

- RSI overloaded at the age of 70, Indicating Potential Turning

Conclusion

Candle Foot Diagrams Can Be An Effective Tool for Analyzing the Fantom Cryptocurrency. By Understanding the Most Important Candle Foot Patterns and Using Relative Strength Indexes (RSI), Merchants can make More Conscious Decisions About Buying and Selling Fantom. Remember to always be careful duration trading and compare your analysis with other market cryptocurrency.

Other Resources

- [Fantom Blockchain Documentation] (

- [FTM Coingecko Price Chart] (

- [CryptoSlate: Fantom (FTM) Trade guide] (